The Definitive Guide for Home Warranty Insurance Cost

Table of ContentsWhat Does Home Warranty Insurance Cost Mean?Fascination About Home Warranty Insurance CostHome Warranty Insurance Cost Can Be Fun For EveryoneAll About Home Warranty Insurance CostThe 10-Second Trick For Home Warranty Insurance CostExamine This Report on Home Warranty Insurance Cost

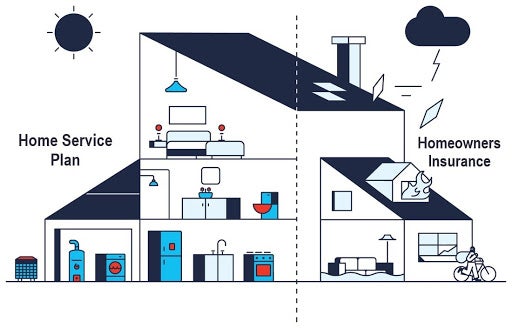

For one, property owners insurance policy is called for by loan providers in order to acquire a home loan, while a home guarantee is entirely optional. As discussed above, a home warranty covers the repair service and also replacement of items and also systems in your residence.Your house owners insurance, on the various other hand, covers the unforeseen. It won't help you change your devices due to the fact that they obtained old, yet home owners insurance policy might help you obtain new appliances if your existing ones are harmed in a fire or flood. With house owners insurance coverage, you'll have to fulfill a insurance deductible before the insurer begins spending for the cost of your case.

How much does a residence warranty expense? Home service warranties typically set you back between $300 and also $600 per year; the cost will certainly differ depending on the kind of plan you have.

The Best Strategy To Use For Home Warranty Insurance Cost

Should you obtain a residence guarantee? Having your air conditioning taken care of under a house warranty will almost absolutely set you back less than paying to have it changed without one.

Some Known Incorrect Statements About Home Warranty Insurance Cost

When checking out the description of a solution contract or a residence guarantee, they can look incredibly comparable and make you question, "What IS the distinction between these?" It's a typical inquiry, however recognizing the difference is very important when choosing which one is the ideal fit for you as well as your residence.

House Service warranties Cars and trucks and smart devices aren't the only items with a guarantee as you can acquire one for your home, also. A residence guarantee is primarily a contract to give repair work or a feasible substitute on the significant devices and also systems in your home. When something covered by a home guarantee breaks down, the home owner calls for solution.

What do you leave a home warranty? The benefit of having a home guarantee is the peace of mind that you can relocate without having to pay out big amounts of additional money for repair work you weren't expecting. House owners with recently developed houses can acquire residence service warranties, as well. You're believing, like it however, every little thing is new.

Some Known Factual Statements About Home Warranty Insurance Cost

The agreement with one of the most insurance coverage prices about $30 monthly or $360 each year. The agreement covering your fundamental home heating and also air conditioning expenses around $20 each month or $240 each year. There are agreements in between as well as one for click this site every single homeowner's requirements.

It's additionally important to thoroughly check out all strategy documentation since both the pros and also disadvantages can vary based on your place and also the type of plan you select. Here are some considerations to take right into account prior to buying a plan: Not Whatever Is Covered However, your residence service warranty doesn't cover everything.

An Unbiased View of Home Warranty Insurance Cost

Still, is assurance ever a waste? - home warranty insurance cost.

Complete annual costs vary in between $264 and $1,425 per year, depending on the company as well as level of insurance coverage. Along with the cost of the plan, the warranty company bills a service call cost each time you sue that results in sending out a gotten professional to your residence.

Generally, the higher your solution telephone call charge, the less expensive your monthly or yearly costs will certainly be. Many companies provide a repair work guarantee that avoids you from paying a solution call charge greater than once in a specified amount of time if a repair service isn't successful and also a specialist has to return.

Rumored Buzz on Home Warranty Insurance Cost

When a covered thing breaks down, you browse the web or phone call to file an insurance claim, find here and the firm locates a certified specialist to send out to your residence. However, lots of people with home warranties end up not using them, which is one possible downside. You ought to likewise think about the constraints and also exemptions of the warranty contract, including payout caps and excluded components of covered products.

On the high end of the range, the ordinary price is $68. 71 monthly. Month-to-month prices differ by the home warranty firm, the strategy, whether you add optional coverage, where you live, the dimension of your residence as well as various other variables. Service charge resemble deductibles for residence insurance.